Not to start the year out on a downer… but this is will probably be the most important story of 2025 - so you should be prepared!

As we enter 2025, signs of a worsening debt crisis are becoming harder to ignore. From soaring delinquency rates in credit cards and commercial real estate to ballooning government debt, the financial landscape is fraught with risks that could ripple through every corner of the economy.

And the world economy is even WORSE.

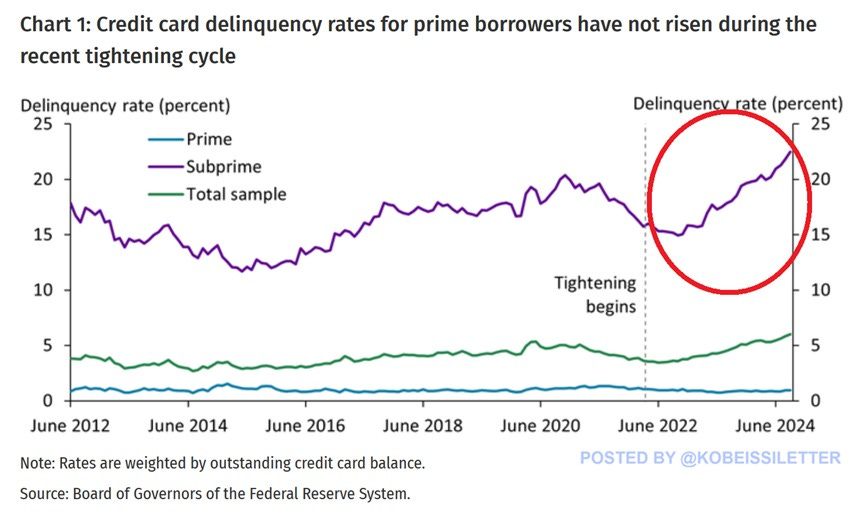

1. The Subprime Credit Card Delinquency Surge

Delinquency rates among subprime credit card borrowers have hit a staggering 22%, the highest since 2010. Over the past 15 months, these rates have climbed by 7 percentage points, reflecting significant financial strain on a demographic that constitutes 23% of the consumer credit market, according to Federal Reserve data.

At the same time, U.S. credit card debt has reached an all-time high of $1.17 trillion, with some estimates placing it above $1.3 trillion. Worse yet, the average interest rate on this debt has surged to 23.4%, a record high.'

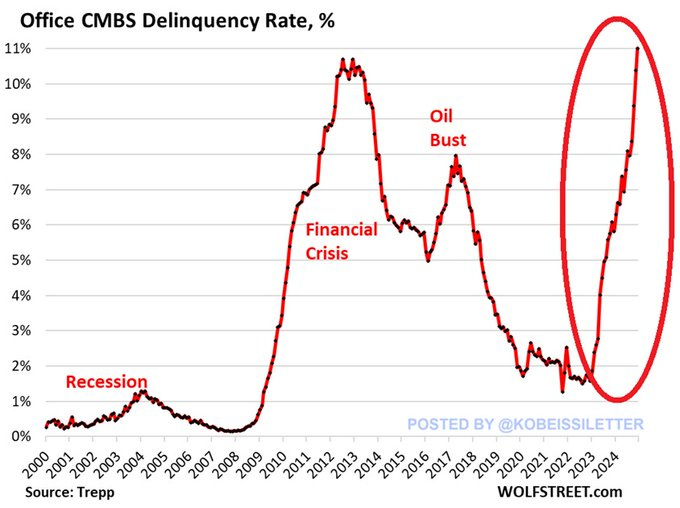

2. Commercial Real Estate: Office Loans in Free Fall

The commercial real estate sector is under immense pressure, particularly in office spaces. Delinquency rates on commercial mortgage-backed securities (CMBS) for offices hit a record 11.0% in December 2024, surpassing the previous peak of 10.7% from December 2012.

Alarmingly, delinquency rates are rising twice as fast as during the 2008 Financial Crisis. Over $2 billion in office loans became newly delinquent in December 2024 alone, marking a 9.4 percentage-point increase in two years. Small banks, which control 67.2% of commercial real estate loans, are particularly vulnerable. These same institutions were at the heart of the regional banking crisis just two years ago.

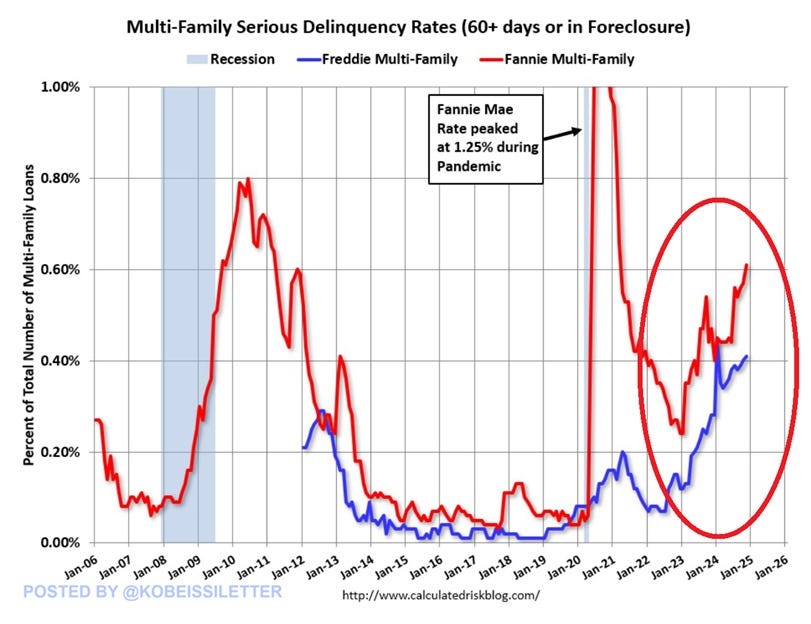

3. Multi-Family Housing Delinquencies Climb

Serious delinquency rates for multi-family housing loans jumped to 0.6% in November 2024, doubling in just 18 months. Outside of the pandemic, this marks the highest level since 2011, with delinquencies rising at a pace reminiscent of 2009.

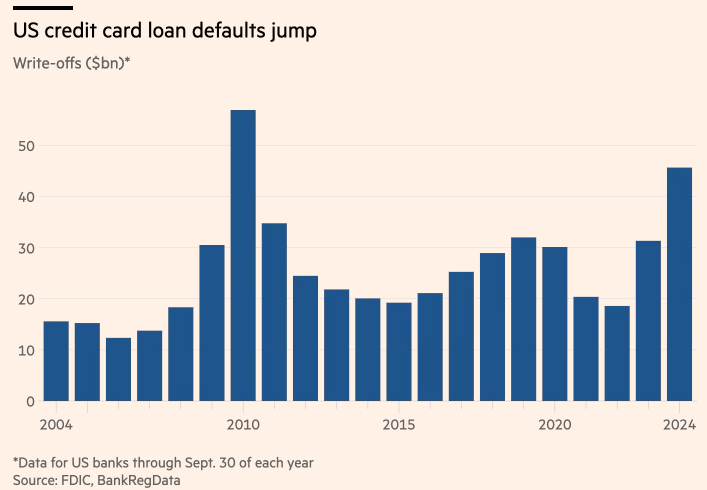

4. Credit Card Defaults Hit New Highs

The broader credit market is also feeling the strain. In 2024, U.S. credit card loan defaults reached their highest level since 2010, with lenders writing off $46 billion in seriously delinquent balances during the first nine months—a 50% year-over-year increase, according to BankRegData.

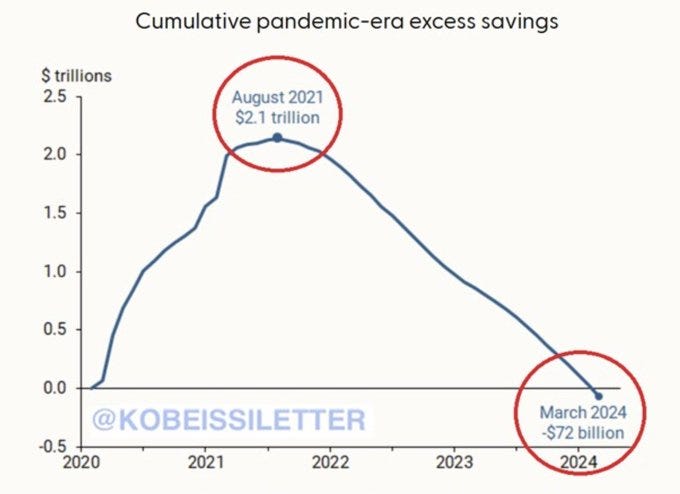

5. Pandemic-Era Savings Fully Depleted

By mid-2024, the financial cushion provided by pandemic-era savings had been entirely erased. Households burned through $2.1 trillion in excess savings in just three years, leaving a negative $170 billion in cumulative savings. This depletion has left consumers financially unprepared for future shocks.

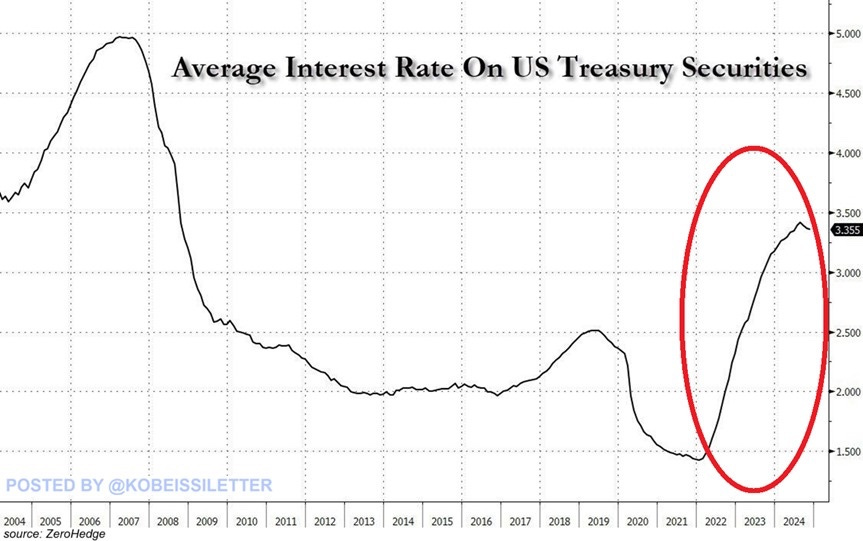

6. The U.S. Debt Crisis: A Ticking Time Bomb

Amid all this, the U.S. government is grappling with its largest debt crisis in history. Federal debt has soared to $36.2 trillion, with the average interest rate more than doubling to 3.4% over the past three years. The rising cost of servicing this debt poses a significant challenge, potentially crowding out other vital spending and destabilizing financial markets.

Key Global Trends and Economic Signals

Chinese Bond Market Collapse: Flight to safety has driven yields on Chinese one-year bonds to record lows amid systemic banking issues.

Global Trade Decline: Imports and exports worldwide have fallen sharply, reflecting a slowdown in global economic activity.

Labor Market Weakness: The U.S. job-finding rate plunged to 21.3% in November, indicating a labor market under severe strain and echoing patterns seen before past recessions.

Additional Data Points and Anecdotes

Auto Industry Overcapacity: European carmakers like Volkswagen are cutting jobs and shuttering factories due to overcapacity and weak demand.

Stock Market Bubble Warning: Equity risk premiums are at historic lows, signaling complacency in the face of systemic risks.

Emerging Market Struggles: Brazil and India are grappling with currency crises, with Brazil’s real showing signs of severe stress.

Repo Market Tensions: U.S. repo fails surged to over $200 billion for three consecutive weeks, signaling liquidity stress.

Safe Haven Demand: The U.S. dollar has strengthened significantly, reflecting global economic uncertainty.

What’s Next?

The confluence of these challenges underscores the fragility of the current financial system. The need for adaptive strategies and robust risk management has never been greater. Stay informed and prepared

Great observations…while some of the items will fortunately impact specific companies/industries (think credit cards)…most of the items noted will really hurt the average American. For years we’ve heard about the great reset (which will usher in a one world government - total BS). This reset will be within the financial systems/markets in which assets (and liabilities) will have to be reset to what the economy/society can manage. We have to get away from this fiat currency system to one that is backed by real assets (think gold). We’ll have to slash spending to where people/companies/governments can live within their means. The only problem is such corrective measures are difficult and people will resist…but adjust they will. Low interest rates will not solve this nor the printing of more money. Again, I doubt we have the political will to do what is right. Thus, I would not be surprised if there is more conflict and more regional wars. Remember, when all else fails they take you to war.

You bet Justin!

2024 started to warm up with various truths coming to light. Like Zuckerberg admitting he curtailed and omitted FREE SPEECH on his FACEBOOK platform, after supposedly being pressured by the Biden's corrupt US Government to keep Covid details and Vax dangers hidden from the world. He thinks we don't realise he was enthusiastic about the entire NWO Plot!

At the end of 2024, 16 US States have banned the promotion of Covid mRNA (Deadly) injections.

We hope this trend becomes an avalanche of realisation that the whole thing was a man-made Scam to 'depopulate' and imprison the remaining population to become SLAVES of the 'Elite'.

Who knows, maybe even Trump might prove to be 'genuine' by making Big Pharma LIABLE for the injuries and DEATHS caused by their dangerous, but shielded' injected poisons?

Unjabbed Mick (UK) We live longer by avoiding corrupt medics with poisonous mRNA syringes.