Despite the recent narrative of a "soft landing" and a supposed regret by the Federal Reserve for cutting interest rates, the Fed's own data paints a much bleaker picture. The latest Beige Book, a collection of anecdotal economic evidence gathered by the Fed's regional branches, reveals a stark deterioration in the US economy over the summer months, casting serious doubt on the optimistic claims of a rebound.

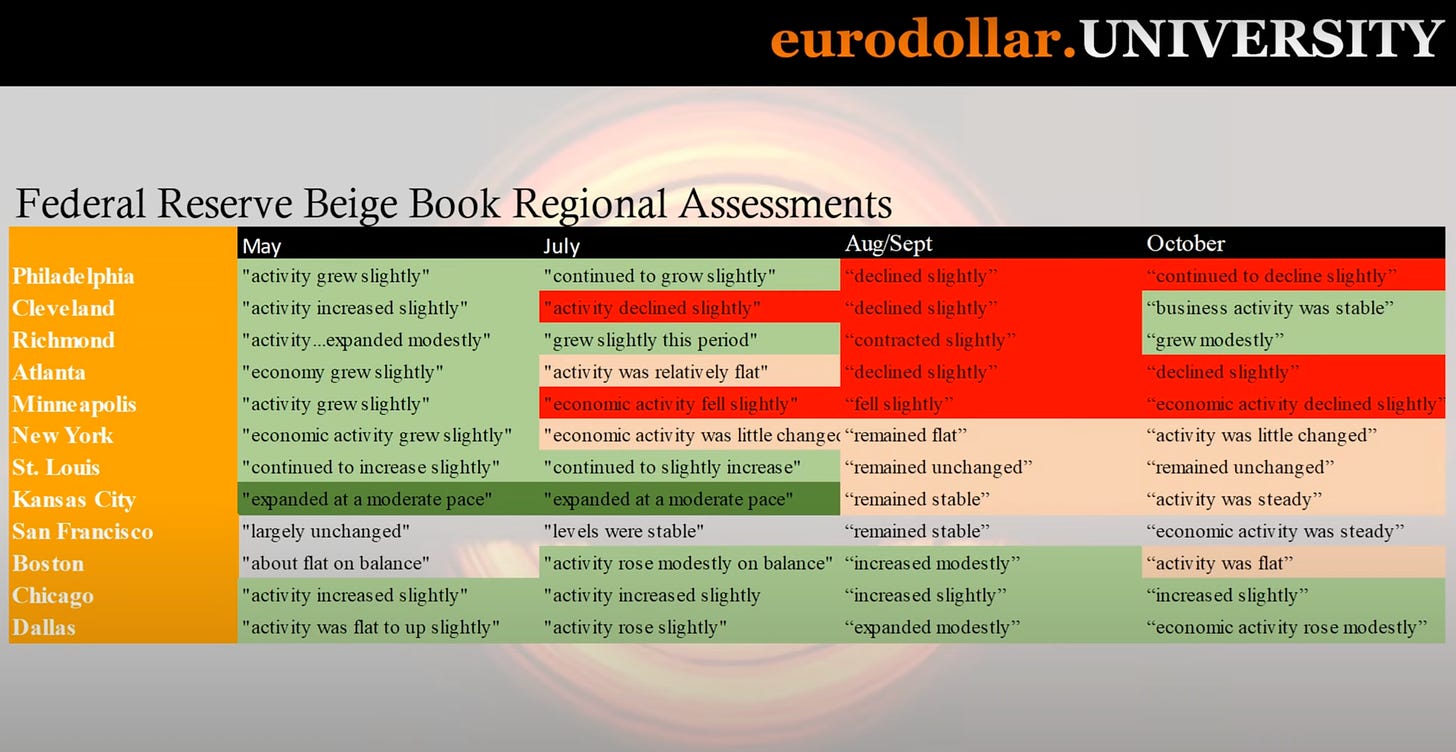

The Beige Book, released in October 2024, shows a significant shift from May 2024, where almost all districts reported economic expansion. By July, cracks began to appear, with some districts downgrading their assessments to flat or even slight contractions. September brought a sea of red, with most districts reporting outright economic decline, particularly in manufacturing activity.

Here’s a short clip of our friend Jeff Snider over at Eurodollar University explaining it in great detail:

This trend continued into October, with little improvement and most districts remaining in contractionary territory. The report highlights a worrying lack of hiring, growing concerns about potential layoffs, and a shift in consumer spending towards less expensive goods, all pointing to an economy struggling to gain traction.

This paints a stark contrast to the "soft landing" narrative being pushed by some. The Fed's own data suggests that the US economy is in a much more precarious position than many realize.

Here's a detailed breakdown of the key concerns highlighted by the Beige Book and other indicators from the past 2 weeks

Global Economic Slowdown & Recession Concerns: A global slowdown is hitting hard, with demand for goods plummeting and multiple indicators pointing towards potential recession.

Global Demand: Worldwide demand for vital economic goods has nosedived by 50%, signaling a significant global economic slowdown.

ASML: Bookings for ASML, Europe's most valuable tech company and a key chipmaking equipment supplier, plunged by over 50% in Q3 2024 compared to the previous quarter, missing analyst expectations and indicating a major shift in global chip demand.

LVMH: LVMH, a luxury goods giant, reported a 3% year-over-year revenue decline in Q3 2024, marking its first revenue drop since 2020 and reflecting a weakening in high-end consumer spending.

Oil Prices: Oil prices have fallen significantly (WTI below $70 per barrel), driven by weak demand despite stimulus efforts in China and elsewhere.

IMF Forecast: The IMF downgraded its global growth forecast for 2025, citing risks like wars, trade protectionism, and financial market volatility.

Recession Signals: Multiple indicators point towards a potential recession, including rising loan losses, declining manufacturing activity, weak consumer spending, and a softening labor market.

Labor Market Weakness & Consumer Distress: A weakening labor market is fueling consumer anxieties, leading to decreased spending and rising financial distress.

Hiring Freeze: Many companies are experiencing a hiring freeze, focusing on replacing existing employees rather than expanding their workforce.

Job Security Fears: Consumers report increasing pessimism about job security and the ability to find new jobs if they are laid off.

Consumer Spending Shifts: Consumers are shifting their spending away from discretionary items towards essential goods and services due to lost purchasing power and economic uncertainty.

Loan Losses: Banks are reporting a surge in loan losses, particularly in consumer loans like credit cards and auto loans, indicating financial stress among consumers.

Ally Financial: Ally Financial tightened lending criteria for auto loans due to elevated charge-offs, suggesting growing difficulties for consumers in accessing credit.

Debt Payment Concerns: An increasing number of Americans fear they will miss debt payments, reflecting growing financial insecurity.

China's Economic Woes & Stimulus Efforts: China's economic troubles continue to escalate, with deflationary pressures mounting and stimulus efforts proving ineffective.

Deflationary Shock: China faces a growing deflationary shock, with falling producer prices, declining wages, and weak consumer spending.

Real Estate Crisis: China's real estate crisis continues to weigh on the economy, leading to local government debt problems and reduced land sales revenues.

Stimulus Skepticism: Markets are skeptical about the effectiveness of China's latest stimulus efforts due to a lack of concrete details and previous failures of similar programs.

Export Slowdown: China's export growth slowed sharply in September 2024, suggesting weakening global demand for Chinese goods.

Weak Loan Growth: The outstanding stock of bank loans in China hit a record low growth rate, signaling a reluctance to lend and invest within the economy.

Interest Rate Policies & Central Bank Actions: Central banks worldwide are scrambling to react to the slowing economy, but their actions are raising more questions than answers.

Synchronized Rate Cuts: Central banks around the world are accelerating their rate cut schedules in response to slowing inflation and economic weakness.

Bank of Canada: The Bank of Canada surprised markets with a 50 basis point rate cut in response to falling inflation and a softening labor market.

ECB Rate Cuts: The ECB accelerated its rate cut timeline, lowering rates in October despite earlier plans to wait until December.

Fed Rate Cuts: The Federal Reserve cut rates by 50 basis points in September, but some speculate they may regret the move due to a single strong payroll report. However, other data and the Fed's own Beige Book suggest ongoing economic weakness.

Questioning Central Bank Relevance: The synchronized actions of central banks raise questions about the relevance of national monetary policy in a globally interconnected economy. Some suggest interest rates could be set by market mechanisms instead.

Market Signals & Trends: Market indicators are flashing red, reflecting a growing sense of pessimism and concern about the future.

Copper/Gold Ratio: The copper/gold ratio has fallen below 0.01% for the first time in years, signaling growing economic pessimism and potential recessionary risks.

Interest Rate Swap Spreads: Interest rate swap spreads continue to hit record lows, indicating expectations of lower growth, lower inflation, and persistently low interest rates.

Treasury Bills: Treasury bill yields remain relatively stable, suggesting the market anticipates further rate cuts despite recent increases in longer-term treasury yields.

Automaker Credit Spreads: Credit spreads for automakers are rising in the bond market, reflecting investor concerns about the sector's weakening sales and financial outlook.

The message from the Beige Book is clear: the US economy is not as healthy as the "soft landing" narrative suggests. The real story is one of slowing growth, mounting anxieties, and a potential recession looming on the horizon.

Company-Specific Issues from Eurodollar University Transcripts (October 16-24, 2024)

Here's a breakdown of company-specific issues identified in the Eurodollar University transcripts:

ASML (Semiconductor Equipment Manufacturer):

Significant Bookings Drop: Q3 2024 bookings plunged by over 50% compared to the previous quarter, significantly missing analyst expectations.

Demand Concerns: This drop indicates a major shift in global chip demand, with customers expressing uncertainty about their own clients' needs.

Revised Revenue Forecast: ASML trimmed their 2025 revenue forecast from 30-40 billion euros to 30-35 billion euros, reflecting reduced growth expectations in the semiconductor fabrication market.

Gradual Recovery Anticipation: ASML's CEO now anticipates a more gradual recovery in the chip market than previously expected, extending into 2025.

LVMH (Luxury Goods Conglomerate):

Revenue Decline: Q3 2024 revenues declined 3% year-over-year, marking their first revenue drop since 2020.

Weakening Demand: This decline reflects a weakening in high-end consumer spending, indicating caution among even top-income earners.

Misleading Statements: LVMH issued intentionally vague statements downplaying the revenue decline and attributing it to an "uncertain economic and geopolitical environment," attempting to mask the severity of the global economic downturn.

Intel (Semiconductor Manufacturer):

Cost-Saving Measures: Intel announced radical cost-saving measures, including laying off at least 15,000 employees, indicating struggles in the semiconductor market.

Weak Demand Impact: These measures are driven by weak demand for chips, as Intel acknowledges difficulty selling existing inventory.

Ally Financial (Financial Services Company):

Rising Loan Losses: Ally Financial is experiencing a surge in loan losses, particularly in their auto loan portfolio.

Tightened Lending Criteria: They have tightened lending standards for auto loans, increasing verification requirements for employment and income, suggesting growing financial distress among consumers.

Elevated Charge-offs: Retail auto net charge-offs are at 2.24%, considered elevated by Ally's management.

Lowered Net Interest Margin Forecast: Ally has lowered its net interest margin forecast due to the challenging economic environment and tighter lending practices.

Bank of America (Financial Institution):

Declining Net Income: Bank of America reported a 12% year-over-year decline in net income, citing rising expenses and higher loan losses.

Increased Loan Loss Provisions: Their loan loss provision was $1.53 billion in Q3 2024, up from $931 million in the year-ago period, reflecting growing credit concerns.

Declining Net Interest Income: Net interest income fell 2.9% year-over-year to $14.1 billion, indicating pressure from falling interest rates.

JP Morgan Chase (Financial Institution):

Flat Net Interest Income Growth: Net interest income at JP Morgan Chase grew by only 3% year-over-year, with growth excluding the market segment at a mere 1%.

Expected Net Interest Income Decline: The company forecasts a slight decline in net interest income to $22.9 billion in the coming quarter.

Rising Charge-offs: Net charge-offs in Q3 2024 reached $2.1 billion, with an additional $1 billion added to their net loss reserve, primarily driven by credit card losses.

Citigroup (Financial Institution):

Below-Expectation Net Interest Income: Citigroup's net interest income of $13.36 billion fell below expectations and was down 3% year-over-year.

Sharply Higher Loan Losses: Loan losses jumped to $2.7 billion in Q3 2024, up from $1.8 billion in the same period last year, driven by higher credit card charge-offs.

CSX (Railroad Company):

Lower-Than-Expected Revenue: CSX reported lower-than-expected Q3 2024 revenue due to declining demand for coal, metals, fertilizer, and cars.

Weak Automotive Market: The company specifically cited automotive markets as a significant weak spot, impacted by diminished consumer demand.

PPG Industries (Paint Manufacturer):

Trimmed Sales and Earnings Outlook: PPG Industries lowered their full-year organic sales and earnings outlook due to a slump in automotive production in the US and Europe.

Volkswagen (Auto Manufacturer):

Job and Production Cuts: Volkswagen announced job and production cuts in Germany for the first time in its history, citing weak demand and a lack of recovery in Europe's car market.

Reduced Sales Expectations: They expect annual European car sales to remain at around 14 million vehicles, significantly below pre-pandemic levels of 16 million.

Ford (Auto Manufacturer):

Implied Financial Issues: While not explicitly named, Ford is likely facing similar challenges as other automakers due to the weakening demand and broader industry struggles.

General Motors (Auto Manufacturer):

Implied Financial Issues: Similar to Ford, General Motors is also implicitly included in the discussions about the auto industry's woes, suggesting they are experiencing comparable difficulties.

These company-specific issues highlight the breadth and depth of the current economic slowdown, impacting diverse industries across the globe. The consistent theme across these reports is weakening demand, rising financial distress among consumers, and growing concerns about the future economic outlook.

Are you implying the Feds are lying to us?

The only government book that matters is the dark black book where all the pages are black. You can assume that humanity suffered a hard landing.