A Storm Brewing: The Alarming State of the U.S. Jobs Market

As I delve into the latest data ahead of tomorrow's September payrolls report, I can't help but feel a growing sense of unease. The signs are unmistakable: our labor market is signaling distress, and the metrics are painting a bleak picture that demands our attention.

Let's break down the key indicators that are flashing red:

Hiring Has Plummeted to Historic Lows

The hiring rate has crashed to 1.98% in August, a level not seen since July 2008 during the onset of the Great Recession.

The total number of hires fell to 5.32 million, down from 5.42 million in July, marking the second significant drop in three months.

When adjusted for population, this hiring rate is only marginally above the lowest points of May 2020 and June 2024, periods marked by extraordinary economic turmoil.

Job Openings Data Is Misleading

While job openings slightly increased to over 8 million from 7.71 million in July, this uptick is deceptive.

The Job Openings and Labor Turnover Survey (JOLTS) data on openings is notoriously unreliable and does not reflect actual hiring activities.

The overall trend in job openings remains downward, offering little solace in the broader context.

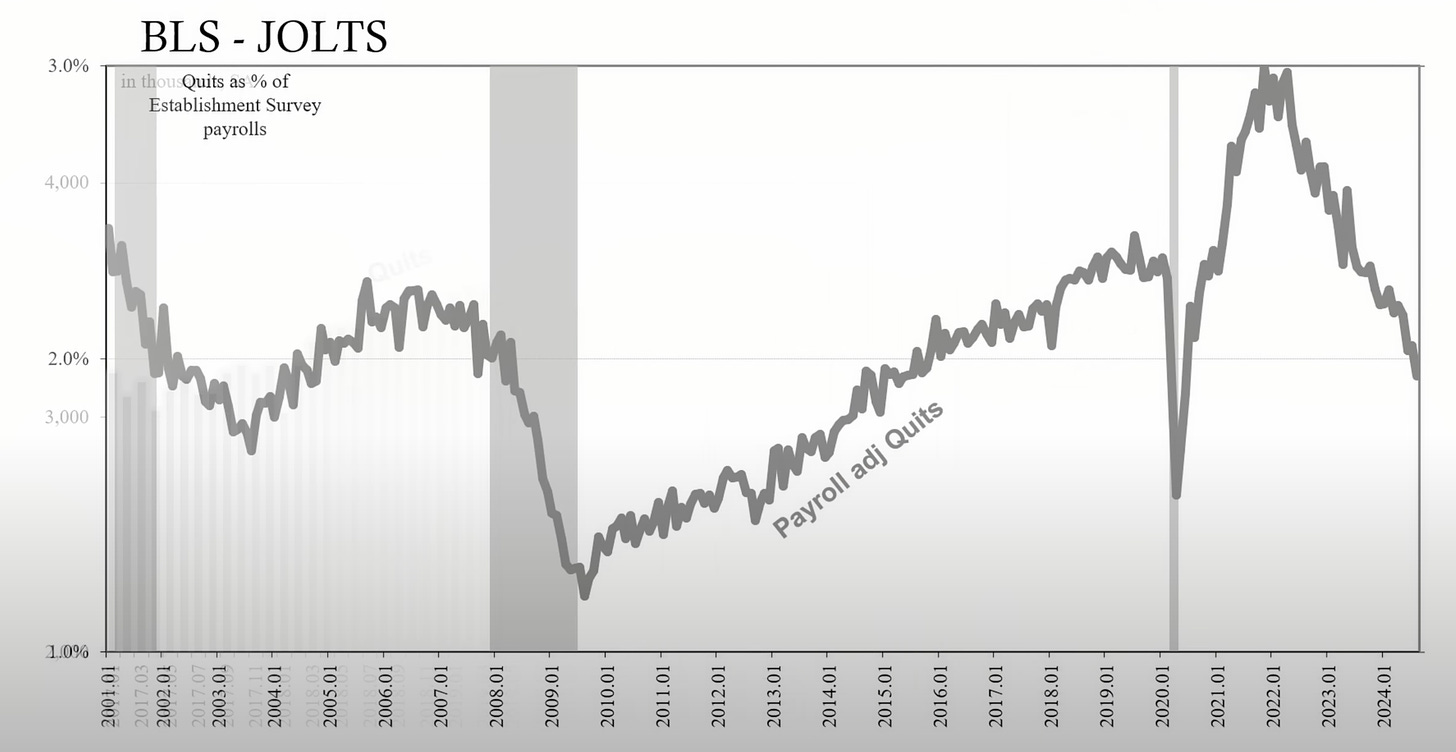

Quits Rate Indicates a Labor Market Freeze

The quits rate has dropped to 1.94%, a level equivalent to March 2020, with only the initial pandemic months of April, May, and June 2020 being lower.

Total quits barely surpassed 3 million in August, matching levels from January 2018 and suggesting workers are hesitant to leave their current positions.

This reluctance reflects a lack of confidence in finding new employment opportunities, signaling stagnation in labor mobility.

Manufacturing Sector Is Contracting Sharply

The ISM Manufacturing Index for September shows a contraction with a reading of 47.2, staying below the neutral 50 mark.

The employment index within the ISM report plummeted to 43.9, marking two out of the last three months under 44—a clear sign of manufacturers reducing their workforce.

Manufacturers report that they are "right-sizing workforces to levels consistent with projected demand," indicating planned layoffs and hiring freezes.

Demand Weakness and Order Backlogs Are Concerning

The ISM notes demand is slowing, with the new orders index remaining in contraction territory.

The backlog of orders index continues in strong contraction, signaling that manufacturers are running out of work and not receiving new orders to replace completed ones.

Customers' inventories are considered "about right," meaning there is no anticipated surge in demand to boost production.

Federal Reserve Actions Highlight Underlying Worries

Despite public assertions of the economy's "solid footing," the Federal Reserve enacted a 50 basis point rate cut in September.

This significant cut suggests that the Fed is more concerned about economic weakness than it's willing to openly admit.

Chicago Fed President Austan Goolsbee contradicted Chair Jerome Powell, emphasizing the need to "hurry up and cut rates" due to real dangers in the labor market.

Consumer Confidence Is Eroding

Consumer confidence indices are declining, reflecting growing pessimism about employment prospects and economic conditions.

This erosion can lead to reduced consumer spending, further slowing economic growth and exacerbating labor market challenges.

Historical Parallels Are Unsettling

Current hiring and quits rates are mirroring those seen in 2008 and the early 2000s, periods preceding significant economic downturns.

The rapid decline in hiring without a corresponding increase in layoffs suggests a prelude to more severe labor market adjustments.

Labor Market Dynamics Are Shifting Negatively

The lack of hiring is a critical recession trigger; prolonged hiring freezes often precede widespread layoffs.

Workers' decreased mobility and employers' cautious outlook contribute to a feedback loop of economic stagnation.

Given these alarming metrics, it's evident that we're facing a convergence of negative forces in the labor market. Employers are not just slowing down on hiring—they're preparing for a downturn by adjusting their workforce levels now. Workers sense this shift, opting to stay put rather than risk unemployment in a tightening job market.

The Federal Reserve's actions, particularly the substantial rate cut, indicate that they're acutely aware of these issues, even if public statements suggest otherwise. The disparity between the Fed's public confidence and its policy decisions should not be overlooked.

It's crucial to understand that rate cuts alone won't fix the labor market's underlying problems. They're reactive measures, not proactive solutions. The real issue lies in declining demand, both domestically and globally, affecting manufacturing and service sectors alike.

I wonder how much the 11 Trillion pumped in last 4 years has a role to play. Clearly that pumping led to the sudden rise in inflation. I wonder how much of this money is still in play. While they can pass through several hands, they probably are all floating in the economy. Moreover, I suspect that for every $ given to common man, they probably handed over a million to their friends on Wall Street and Silicon Valley, who then proceeded to gamble on everything in the market or buy Nvidia GPUs to do worthless research into GPTs.

I have not seen anybody talk about some kind of sensitivity analysis wrt Fed pulling back all those freebies. Isn't that the elephant in the room?

From a Silicon Valley angle, the money has opportunity cost that is being eaten away by the likes of Go-ogle, Meta-staticized, OpenAI, and a ton of other Silicon Valley companies that promise (loudly and clearly everyday) to make us all unemployed. I wonder how much of the demand loss is because of this squandering.