The global economy is unraveling right before our eyes, and it’s time we acknowledged the truth: we are in a recession. No, not just a downturn, not just a slowdown—this is a full-blown recession, and the data bears it out. From credit card shutdowns and weakening consumer confidence to deteriorating labor markets across the world, every indicator points towards a looming and potentially prolonged economic crisis. What we’re seeing now isn’t just the usual cyclical dips; it’s the sign of something far more sinister.

This post brings together recent data, expert commentary, and financial signals that are blaring loudly for anyone who cares to listen. It's time we face the uncomfortable truth—no amount of wishful thinking or temporary payroll “surges” can hide the broader picture. Below, you’ll find a comprehensive look at the data points that are screaming recession, highlighting what’s unfolding globally:

Recession Signals & Trends:

China's Banking Crisis and Credit Conditions:

China is currently undertaking a major recapitalization effort for its six largest banks, injecting up to 1 trillion yuan (approximately $137 billion) to stabilize its banking sector. This follows an alarming increase in non-performing loans, reported to be 1.3 trillion yuan as of June 2024, up 4% since December 2023. This massive bailout effort, the first since the global financial crisis, underscores the depth of the banking system’s troubles, especially as banks continue to pull back on credit due to hidden losses and balance sheet constraints.

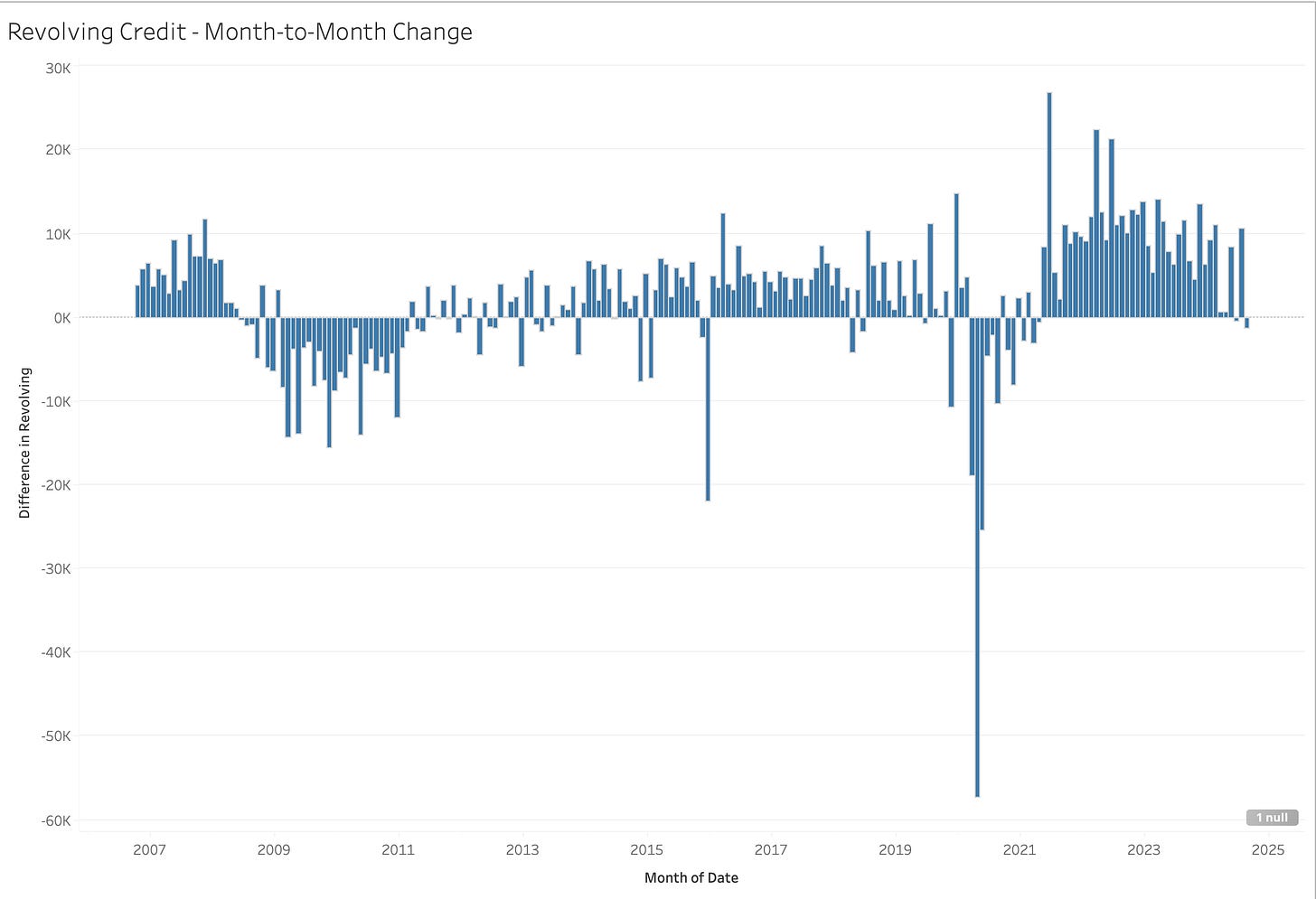

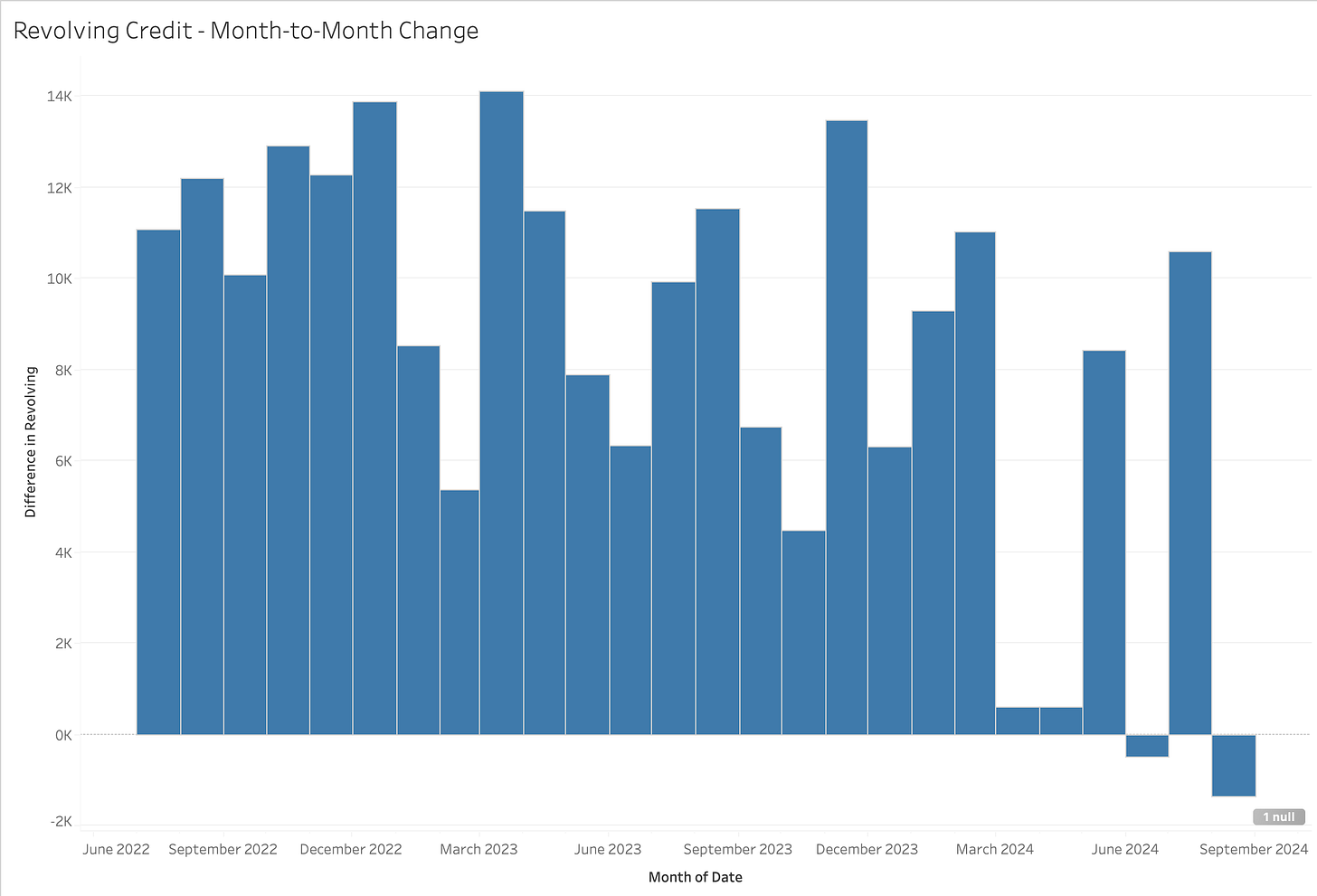

Decline in Credit Card Usage:

ZOOMED IN

The Federal Reserve reported a seasonally adjusted aggregate balance decline in revolving credit for the second time in three months. Credit card usage has fallen significantly since March, indicating that consumers are pulling back in fear of economic uncertainty. Historically, such behavior closely correlates with rising unemployment rates and a worsening labor market. Consumers aren’t just saying they’re worried; they’re acting on it by paying down balances and refraining from additional debt—clear recession behavior.

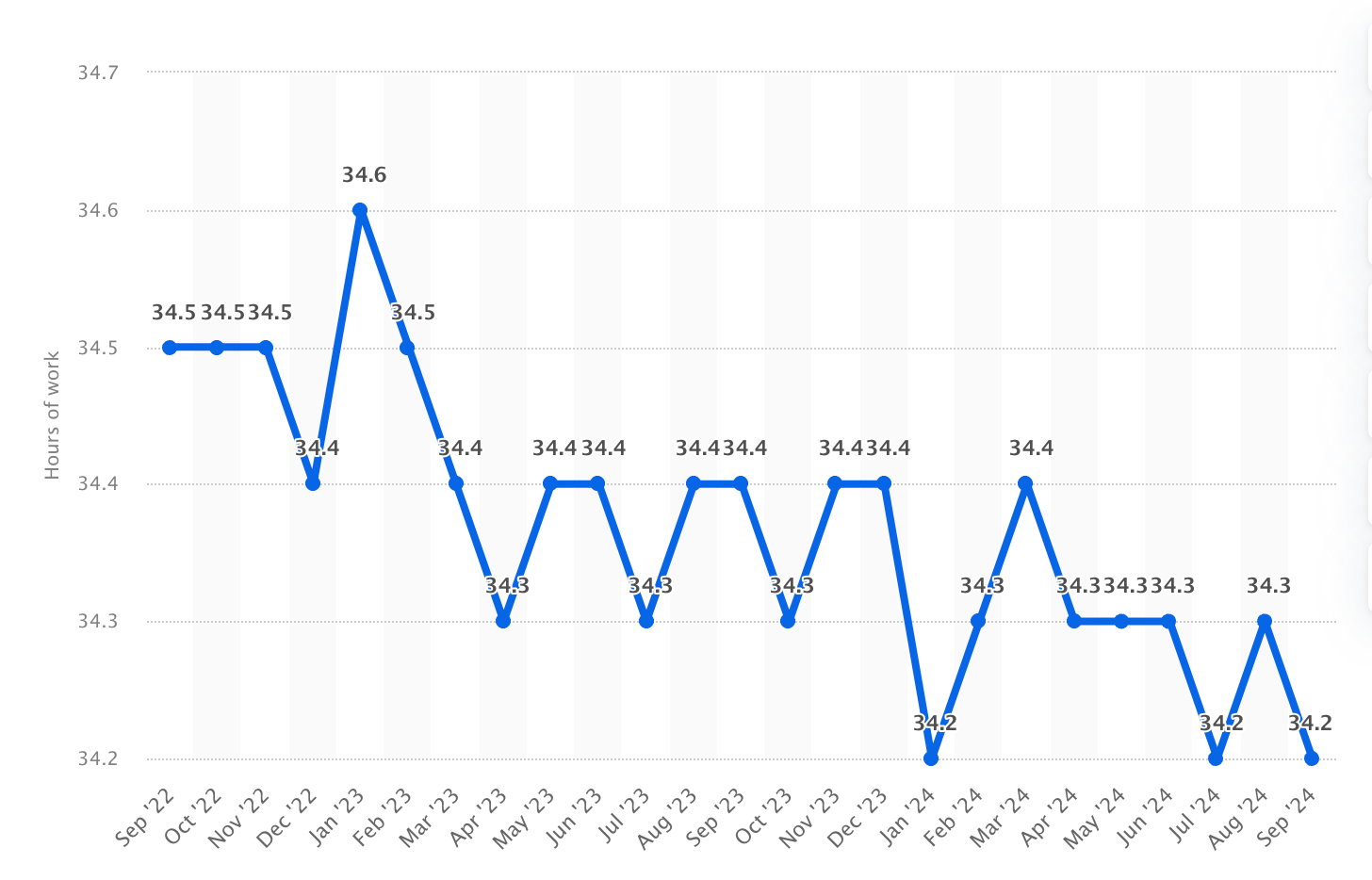

Labor Market Deterioration:

The September payroll report may have grabbed headlines with positive numbers, but the reality underneath paints a much bleaker picture. The average workweek fell to 34.2 hours—a clear recession signal that suggests employers are cutting back on hours even if they aren’t yet laying off workers en masse. Hours worked have been flat over the past six months, mirroring similar trends seen in the 2001 and 2008 recessions.

Hiring plans have also plummeted. According to Challenger, Gray & Christmas, employers in the U.S. announced just 483,000 hiring plans for 2024—the lowest year-to-date hiring since 2011. The labor market's resilience is largely an illusion, driven by seasonal adjustments and government hiring, not by real economic strength.

September’s payroll report delivered what seemed like great news, with 254,000 jobs added. However, adjusted data shows 223,000 new private jobs and 32,000 new government jobs, heavily skewed by seasonal adjustments. Unadjusted numbers reveal 918,000 new government jobs but a decline of 458,000 private jobs. The household survey indicates that 86% of new jobs in September were government jobs, highlighting the fragility and imbalance of this job growth. The quality of new jobs is uneven, with higher-paying sectors like manufacturing and tech seeing job losses, characteristic of a recessionary environment.

Consumer Confidence in Decline:

Consumer credit balances declining isn’t just about spending less—it’s a reflection of confidence, or rather, the lack thereof. The Conference Board recently reported that consumer assessments of current business and labor market conditions turned negative in September. People are pessimistic about future conditions, which is leading them to pull back from spending and taking on new credit.

Global Weakness Mirroring U.S. Trends:

The economic weakness isn’t confined to the United States. Japan’s key leading economic indicator recently dropped to its lowest level since October 2020. Japan is once again sliding into recession, impacted by global economic frailty, including a significant drop in exports to the U.S. The Bank of Japan has now shelved any plans for further rate hikes, recognizing that economic deterioration is not just likely—it’s already happening.

Similar trends are seen in Mexico, where the manufacturing PMI fell to a 32-month low, reflecting a sharp downturn in demand. Mexican officials even blame the slowdown on U.S. election uncertainty—a diplomatic way of pointing fingers at deeper economic frailties in their northern neighbor.

The Payroll Mirage:

September’s payroll report delivered what seemed like great news, with 254,000 jobs added and a drop in unemployment. But look closer: the gains were heavily concentrated in sectors like leisure, hospitality, and government, while higher-paying sectors like manufacturing and tech actually saw job losses. This kind of lopsided growth is typical of a recessionary environment where the quality of new jobs doesn’t match up to previous employment levels.

Credit and Hiring Freeze as Recession Confirmations:

Revolving consumer credit balances declined by $1.35 billion in August 2024—the largest decline since 2021. Banks are tightening credit lines, and fewer consumers are qualifying for new cards, indicating that financial institutions are preparing for tougher times ahead.

The labor market's leading indicator, the JOLTS data, shows a sharp decline in job openings and a significant drop in the quits rate. People aren’t quitting their jobs—they’re staying put, knowing that there are fewer opportunities elsewhere. This kind of worker behavior signals a broad expectation of a weakening labor market.

Bond Market and Rate Cuts:

Despite the Federal Reserve's rate cuts in September, the bond market hasn’t reacted in a way that suggests optimism. Instead of yields dropping further, they’ve begun to rise again—a clear indication that markets see rate cuts not as a solution but as a reaction to worsening conditions. Historically, rising yields after initial rate cuts point towards deeper fears about economic sustainability.

The Bottom Line

All of the above signals—China’s banking crisis, falling credit card usage, a shaky labor market, declining consumer confidence, and global economic strain—are consistent with an economy that is already in recession, even if official definitions lag behind. The headlines about payroll numbers and one-off economic data points might make for good soundbites, but the broader, underlying reality is clear: we are facing a significant economic downturn.

It’s time we stop kidding ourselves. This is not a "soft landing." It’s not a temporary blip. The economic pain that’s spreading across the globe, from China to Japan, Mexico, and right here in the U.S., is real and worsening. The only question that remains is: how prepared are we to face it?

Hi Justin, this is a GREAT ARTICLE and faces the evil, ugly, and inconvenient truth.

Here's another great TRUTH:

Mankind is under attack by the world’s TRUE COMMUNISTS' CABAL, which is the richest people in the world who want to MONOPOLIZE EVERYTHING, the cabal of monarchies, which includes the Vatican and the communist parties, the bankers, and the billionaires.

This is the cabal of communists, or call them fascists if you prefer, that launched the COVID-19: Great Reset to smash the world’s economy, to force everyone into the digital platforms, to transfer the wealth to the biggest corporations in the world-which is the 'essential industries' and the banks that are 'too big to fail' because they own the system, to bankrupt everyone else-the 'non-essential' useless eaters, and to take the wealth transferring it to the richest in the world via the banking system.

All of which is called the Great Taking, in the 2023 book by that name, (which you can downloard free courtesy of the author), where he explains how the banksters have set up all the insurance in the derivatives markets, and the ‘bail-in’ the banks laws, which will allow them to TAKE IT ALL in the coming COLLAPSE which they engineered.

This is EXACTLY why the WEF arrogantly boasted that: ‘By 2030 you’ll own nothing and be happy’ because the transnational criminal classes that control the World Economic Forum’s banks, finance companies and multinationals will own it all.

That’s what is happening before our eyes, the richest monarchies, the richest bankers, and the richest billionaires, are waging their war on mankind, the GREAT RESET launched in mid-2020 by that woke communist prick "KING CHARLES" - they are using the greatest weapon of the elite, which is the BANKING SYSTEM, to steal everything from everyone.

And in case you have any doubts about my comment on the TRUE COMMUNISTS just reflect on this truth. There are 4 types of central banks ownerships which shows us the true power in the world.

1. Private Owners - this is the model of central banking in the western world. All of the central banks which control the money supply, banking and the economy, are in the hands of secretive owners, but we know who they are because it is the banks that are 'too big to fail' and all of these banks came into existence in the age of Emprie and Monarchies, so the owners are the monarchies, bankers, and the billionaires - the ruling oligarchies.

2. Monarchies - in the nations around the world that call themselves monarchies, that are absolute monarchies, then they own their central banks and control it for the benefit of the ruling oligarchy - e.g. Saudi Arabia, UAE etc.

3. Communist Parties - in all communist nations you will note just before or just after they flipped communist they usually got a central bank. And the central bank is owned, as are all the banks, by the communist party elites - and in this way they seize control over all means of production, and systematically strip the wealth from the people - which is exactly what the CCP is doing right now - they melted down the economy and they are taking 50 years of the wealth created by the people and putting it inn the hands of the party and the ruling oligarchs. Robbery.

4. Central Banks for their Nations People - These are central banks where the government owns the bank, and prints and releases cash into the economic system without any debt or interest, which is the best model for general prosperity. This is how Australia, Canada, and New Zealand rose to prosperity but it was cancelled about the 1970s when corrupt politicians put them into the global system. And impoverished us. It is how Hitler turned Germany around, put the nation back to work, and from 1933 to 1936 put 7 million people back in jobs, and 2 million homeless back in housing, and then built a huge war machine for WW2. And it is how Libya under Gaddafi was a prosperous booming nation - and because he wanted to export this model around Africa the Zionist banking empire targeted him for destruction.

So there are EXACTLY NO CENTRAL BANKS that work for their people anywhere in the world.

We live under the FINANCIAL SLAVERY of COMMUNIST BANKERS that use the financial system, debt, and interest, all under a FIAT MONEY SYSTEM, which means that they create money from thin air from nothing, or central bankers cash printed with paper and ink and having exactly no value, all of this is a GIGANTIC PARASITIC WEALTH EXTRACTION MACHINE - and because they are at the end cycle of 53 years of fiat money since Nixon cancelled the gold window in 1971, they are CANCELLING the US DOLLAR and trying to RESET into a CBDC system, central banks digital currency - because this is the ULTIMATE slavery and wealth extraction and control system, a DYSTOPIAN, DIGITAL PLANETARY SLAVERY SYSTEM-run by the true communists, the banksters.

That's the true Evil that rules humanity.

Ivan M. Paton

This is consistent with Antoni/St Onge's analysis, that we've been in an inflationary recession since 2022: https://brownstone.org/articles/recession-since-2022-us-economic-income-and-output-have-fallen-overall-for-four-years/