The Economy in Crisis: How We Got Here and What’s Happening Now

The global economy is unraveling faster than expected, revealing the aftershocks of stimulus-fueled artificial growth, unsustainable debt, and structural weaknesses across multiple sectors.

This isn't just a temporary slowdown—it's a broad-based economic breakdown. Here’s how we got here and why things are getting worse.

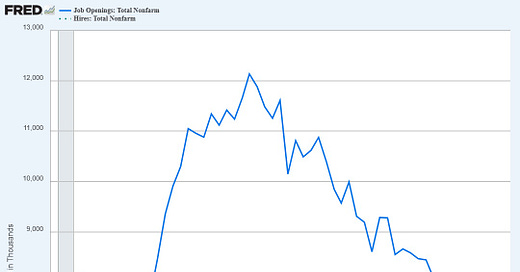

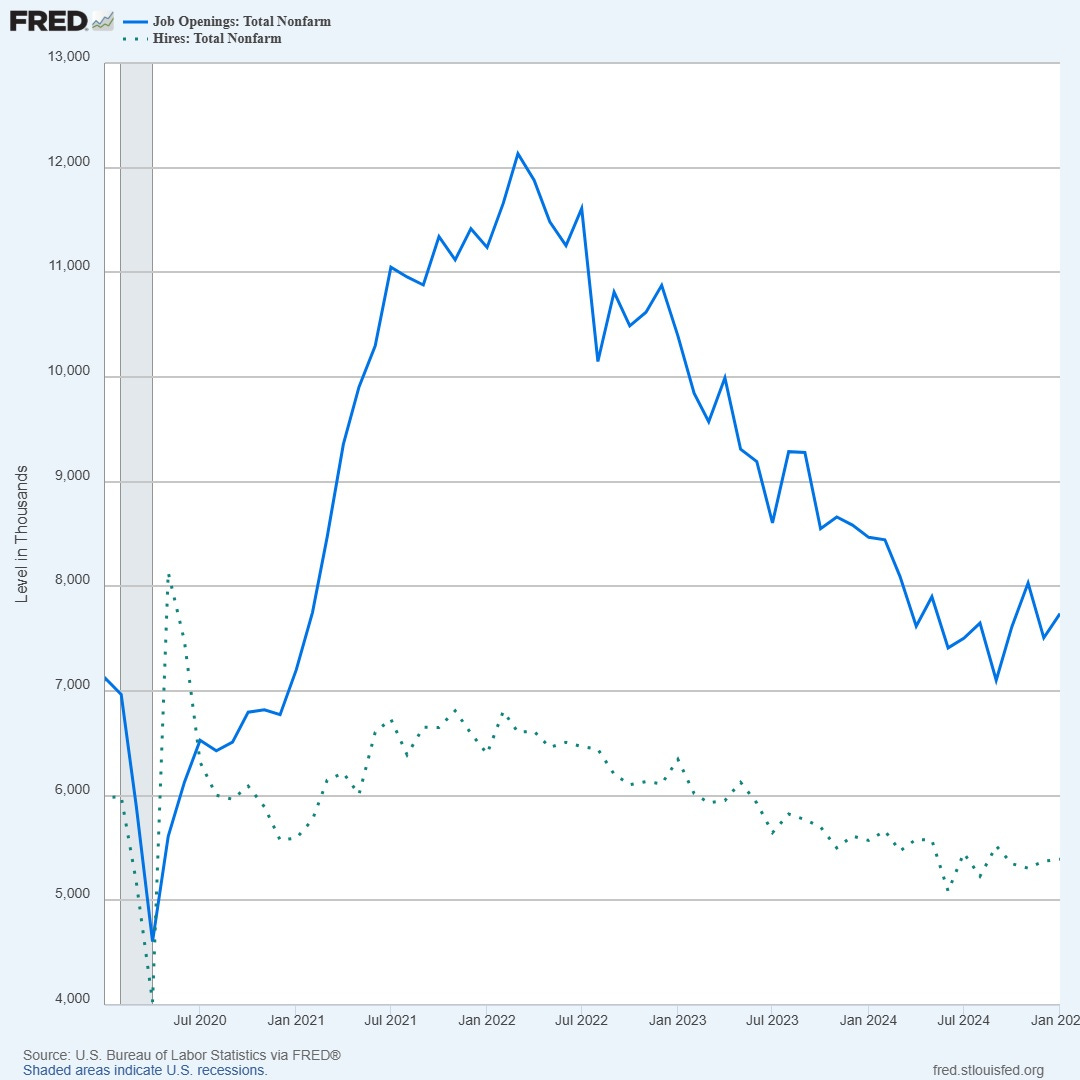

1. Labor Market Breakdown

The labor market has deteriorated significantly, contradicting official narratives of economic strength. Key indicators signal a deep freeze, if not an outright contraction.

Declining Job Openings: Openings tumbled by over 400,000 in late 2024, falling to their lowest level since January 2021.

Low Hiring Rates: Hiring remains subdued, with numbers well below healthy economic levels.

Rising Layoffs & Attrition: Companies are avoiding outright firings but are cutting hours, clawing back bonuses, and offering voluntary buyouts (e.g., Nissan, Chevron).

Declining Full-Time Employment: In February 2025 alone, full-time jobs plunged by 1.2 million while part-time employment rose, signaling weaker job stability.

Decreasing Work Hours: The average workweek fell to 34.1 hours—levels not seen since the Great Recession.

Consumer Fear of Job Losses: The Federal Reserve Bank of New York’s latest survey found rising anxiety over job security, leading to increased savings and reduced discretionary spending.

The "Forgot How to Grow" Economy

This labor market freeze aligns with the broader trend of companies and governments struggling to create sustainable economic growth beyond the sugar rush of stimulus.

2. The Stimulus Hangover & Demand Collapse

What looked like a post-pandemic economic recovery was a mirage fueled by artificial stimulus.

COVID Stimulus Distorted Demand: Incomes surged by 20%, sending false signals to businesses, who overexpanded in response to what seemed like a demand boom.

"Sugar Rush" Reversal: As stimulus dried up, consumers and businesses were left with inflated costs but no sustained demand to support higher prices.

Artificially High Consumer Spending (2024 Tariff-Beating): Many purchases were front-loaded to avoid future price hikes, creating a temporary demand surge. The payback period has now arrived.

Plunging Consumer Confidence: After the artificial highs of 2024, confidence tanked, hitting its lowest levels in over two years.

Savings Rate Increasing: Households are pulling back spending and hoarding cash in anticipation of job losses.

3. Collapsing Corporate Earnings & Business Investment

Businesses miscalculated demand, and now they're scrambling to cut costs.

Massive Corporate Layoffs: Chevron announced job cuts affecting 15-20% of its workforce, citing collapsing demand.

Automotive Sector in Crisis: Nissan, Bridgestone, and others are cutting shifts and offering buyouts as car inventories pile up.

Tech & AI Bubble Cracking: The hype cycle for AI investments appears to be stalling, with companies failing to generate profits from heavy investments.

No Risk-Taking in Banking: The world’s largest banks are hoarding safe assets and avoiding lending—essentially preparing for a downturn.

4. Market Red Flags: Credit, Bonds, and Recession Signals

Financial markets are finally waking up to the economic reality.

Bond Market

Yields Collapsing: The 10-year Treasury yield fell below 4.2%, and the 2-year Treasury is near 3.9%, signaling severe growth fears.

Steepening Yield Curve: Historically, this happens before a recession as investors anticipate rate cuts.

Swap Spreads Compressing & Then Plunging: Wild swings suggest markets are pricing in economic distress.

Credit Market

Credit Spreads at Dangerous Levels: Corporate bond spreads are at their lowest since 2007, just before the last financial crisis.

Complacency Before the Crash: Investors are piling into risky debt despite warning signs.

Lack of Bank Lending: Instead of lending, banks are buying government bonds—just like they did in past economic crises.

5. Global Trade & Commodities Breakdown

Trade and commodities markets confirm the downturn is worldwide.

Baltic Dry Index Crashing: Shipping rates for raw materials have collapsed, signaling lower demand.

Oil Prices Falling for the Wrong Reason: Instead of rising due to seasonal demand, oil prices are dropping due to weak economic activity.

Weak Global Trade Demand: Imports surged in late 2024 as companies rushed to avoid tariffs, but now they’re collapsing.

China’s Economy in Freefall: The Chinese economy failed to recover after reopening, and stimulus efforts have had little effect.

India’s Financial Crisis Worsening: The rupee is collapsing, consumer prices are falling, and the central bank is burning through reserves in a desperate attempt to stabilize the market.

6. Consumers Are Tapped Out

Despite official claims of resilience, consumer behavior suggests otherwise.

Retail Sales Declining: January retail sales came in worse than expected.

Personal Spending Dropping: Consumers are pulling back on discretionary spending, focusing only on essentials.

Debt Stress at Record Highs: The probability of missing a debt payment surged to 14.56%, its highest level since the pandemic.

Auto Loans & Mortgages at Risk: More households are struggling with rising loan payments, signaling trouble ahead.

Conclusion: A Recession is No Longer a Debate

The data makes it clear: the global economy is not in a "soft landing" but rather sliding into something much worse.

The "Forgot How to Grow" economy is giving way to the "Remembering How to Recession" reality.

This downturn isn’t just a short-term correction; it’s the result of years of distorted policy decisions, misallocated capital, and an economic system propped up by government intervention that could never create sustainable growth.

Markets are now finally coming to terms with this reality—expect more pain ahead.

At least this happens under Trump and not Kamala. We may feel the pain now, and I bet it won’t be as deep or long of a recession under the Trump admin. The last steward admin was just buying time to keep the globalists in power for as long as possible.

I think you’re wrong …yes the economy is bifurcated and the poor are doing poorly.

But the earnings are fine…the problem is obiden 10 trillion in give aways to illegals and fake jobs to buy votes.Our economy has been garbage since trump was deposed by the Marxist global cabal.

Yes it’s going to take time to fix but TRUMP will do it_..that’s why I voted for him…you’re wrong on most of your points..